CielosGrises

Player Valuation: £25m

Everton Candies

Heyyyyy, come onGet these yanks out of our club

Yeah, to be perfectly honest I just saw an image of Bannon and Farage sat with him at a table and Farage’s smug face set me off.Let’s not get too carried away about this Bannon and Farage stuff, it might be exaggerated. Thornton knows Bannon from their Goldman Sachs days. He was pictured having lunch with Bannon and Farage in 2018. At the same time he is reported to be involved with a left-leaning think tank.

Sounds very much like your typical investment guy who is all about the money and blows with the political wind. Anyone whose job involves a finger on the political pulse would’ve been interested in a lunch with Bannon and Farage in 2018 as populism was the way the wind was blowing. It doesn’t mean he is seriously ideologically aligned. And certainly, unlike the sportswashing projects, his involvement with a football club wouldn’t be in furtherance of whatever his political views are.

And hoppy IPA's. What's not to like.Bet there will be boss hot dogs for sale in the concessions stands . And pretzels

Maceik Kaminski who is providing most of the finances for the bid

Total assets - $72,254,172

Total Liabilities - $83,109,284

Net Loss - $2,815,977

Net losses

2014 - $3.9m

2015 - $7m

2016 - $7.8m

"In 2014, Talon purchased real property located in downtown St. Paul with a street address of 180 East 5th Street (the property) for $40 million. The property is a 13-story office tower, was built in 1916, and is mostly leased to commercial and government tenants. To finance the purchase, Talon mortgaged the property to GREC and executed a promissory note.

On January 27, 2017, GREC lent Talon $51.6 million under new terms to refinance Talon's indebtedness, pay fees, and make improvements to the property."

Gamma Lending Omega, LLC v. Talon First Trust, LLC, A18-1205, 2 (Minn. Ct. App. Apr. 22, 2019)

"One year later, Talon defaulted and Gamma sued Talon and its owner, Talon OP L.P. "

“Additionally, the record establishes that GREC was aware of Talon's financial situation at the time it issued the 2017 loan. More than $29 million of the new loan was required to pay off Talon's preexisting debt from its 2014 purchase of the property. ” Gamma Lending Omega, LLC v. Talon First Trust, LLC, A18-1205, 15 (Minn. Ct. App. Apr. 22, 2019)

Twin Cities real estate investor Maciek “M.G.” Kaminski is trying to hang on — hang on to his properties and hang on to his health. He has already lost many of his commercial real estate holdings, and now faces losing the Parkdale Office Complex in St. Louis Park.

Kaminski, principal of Kasa Real Estate, is the owner of the six-building, 555,945-square-foot Parkdale complex, and he’s on the hook for a $50.1 million mortgage there.

Kaminski was allowed to keep his office in the Parkdale Plaza building, but Colliers built a wall that separates him from the rest of the first-floor property-management suite.

Kaminski’s real estate investment record hasn’t been stellar. Over the past few years, he’s handed back the keys to two other office projects in the west metro: the Boat Works building in Wayzata and the Pentagon Park office complex in Edina.

The Boatworks Building, home to the upscale NorthCoast restaurant on Lake Minnetonka, is headed into foreclosure.

The downtown Wayzata office building is scheduled to be auctioned off at a Hennepin County sheriff's sale May 6 with about $30 million owed on the mortgage, according to a foreclosure notice that appeared Wednesday in Finance and Commerce.

It's the latest building owned by Wayzata property investor M.G. Kaminski to fall on hard times after the commercial real estate crash. A large piece of Pentagon Park, an office park in Edina with multiple buildings that Kaminski once owned and planned to redevelop, went into foreclosure last year.

Fixed that for youEverton Blue waffles

Good research, looks to me we would be leveraged to the hilt similar to Burnley if that move was to go ahead, downside for us is our assets and debts would be heavily exposed and we would go pop within a decade if something bad was to happen.Here we go then, because I obviously have nothing better to do.

I bloody hope not!

Maciek “M.G.” Kaminski

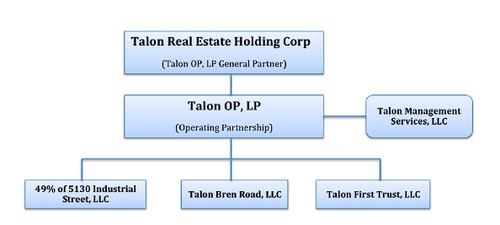

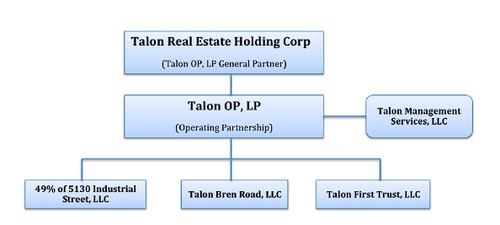

Talon Real Estate Holding Corp.

Accounts for 2016 & unaudited 2017.

Talon Real Estate Holding Corp. 2017 Quarterly Report 10-Q

Security and Exchange Commission SEC Talon Real Estate Holding Corp. Form 10-Qsec.report

To my untrained eyes it looks like the parent company purchases property using loans provided by subsidiary holdings.

^ You'll want to click that to see all the loans.

Talon First Trust, LLC actually defaulted on a massive loan not too long ago when they were taken to court by Gamma Lending Omega, LLC as they didn't pay the late payment fees.

Gamma Lending Omega, LLC v. Talon First Trust, LLC, A18-1205 | Casetext Search + Citator

Read Gamma Lending Omega, LLC v. Talon First Trust, LLC, A18-1205, see flags on bad law, and search Casetext’s comprehensive legal databasecasetext.com

From May 2012

From March 2011

Wayzata's Boatworks sinks into foreclosure

Owner M.G. Kaminski calls the Lake Minnetonka building "my last problem child."www.startribune.com

Southern England Fans Liaison Executive (works from home).When the Everton Phoenix Club is formed - think FC United of Manchester - what role will you take up?

I've dibsed comms officer

Kev actually does hate Americans. And puppies.Heyyyyy, come on

Fixed mateI have to wonder, why after spending all this money and finally delivering on a new Stadium Moshiri is considering selling up.... Surely it would make more sense waiting until project is finished and he could command a lager

I think USM would have something to do with it.I have to wonder, why after spending all this money and finally delivering on a new Stadium Moshiri is considering selling up.... Surely it would make more sense waiting until project is finished and he could command a larger